CFO/CRO message

Given the severity of this business cycle, there is a rising level of

importance placed on financial strategy.

We will carry out appropriate capital procurement and investment in order to

enhance corporate value.

①Review of FY2022

Revenue increased 8.4% YoY. This was because in the

International Business demand recovered centered on processed

tomato products as the COVID-19 pandemic wound down, we

made progress with passing on higher costs to selling prices, and

we increased the amount of foreign currency conversions to yen

amid yen weakness.

Core operating income fell 9.4% YoY. This was because soaring

prices of raw ingredients and energy in the Domestic Processed

Food Business exceeded initial assumptions. This caused the core

operating income of this same business to deteriorate, but the

International Business saw core operating income rise similar to

revenue.

In the one year since I became CFO, I worked with management,

related departments and Group companies in Japan and overseas

in an effort to ascertain and address the operating results and

financial condition of each business and subsidiary in a timely

manner so as to cope with the rapid changes taking place in the

operating environment. Earnings were mixed with sales up, but

profits down, but we did pay out a dividend for FY2022 as initially

forecast.

We have also managed to maintain the soundness of our financial condition based on crediting ratings and financial indicators.

We have been working to increase capital efficiency since introducing ROIC as a management indicator in FY2021. Nevertheless,

in FY2022, this indicator fell 1.6 points YoY. This was mainly

because of decreased profits and a large increase in inventories,

which were up 22.1% compared to the previous fiscal year end.

Higher inventories were the results of rising prices of raw ingredients and efforts to secure volume. Amid tight supply-demand

conditions for raw ingredients worldwide, Kagome focused first

on securing stable procurement volume. This worsened ROIC, but

it was also the result of a stable supply of raw ingredients via our

global procurement network built up over many years. More than

just reporting positive or negative numbers, I will examine priorities in today’s management environment and their reasonableness, and fulfill my accountability as CFO.

②Growth investment and

the financial platform underpinning it

As President & CEO Yamaguchi noted in his message, we have

no intention of modifying the vision laid out in the third Mid-Term

Management Plan. We do need to review our quantitative targets

because of the sharp changes in management environment, and,

for business growth, it will be important to push ahead with the

basic strategy of the third Mid-Term Management Plan.

Improving our core operating income margin is a particularly

urgent task. In addition to restoring the profit margin in existing

domains, achieving inorganic growth using M&A and other means

has become even more important. Investment in inorganic growth

during the third Mid-Term Management Plan announced in 2022

will amount to between 30 and 50 billion yen, an unprecedented

amount. At the present, we do not intend to change this investment amount. This is because aggressive investment to accelerate business growth is essential and our financial platform

underpinning this investment remains intact. Our shareholders’

equity ratio stood at 52.8% as of the end of FY2022.

Furthermore, we completed share buybacks for investment in

inorganic growth before the end of FY2022, with treasury stock

amounting to 22.5 billion yen as of the end of FY2022.

This severe business environment is precisely the time to move

ahead with investments aimed at future growth. At the same time,

it is important to maintain the financial platform underpinning

these investments, and we are working diligently toward this end.

③Promoting governance for sound business growth

Building appropriate finance and accounting governance is critical

to sound business growth. This represents the foundation of

Kagome’s business operations just as important as product quality. It also forms a core component of “corporate openness,” an

integral component of our Corporate Philosophy. A corporate

culture of informing stakeholders in a timely and easily understood manner of both positive and negative news is a foundation

that strongly supports our finance and accounting governance.

Going forward, we will continue to maintain and strengthen this

finance and accounting governance.

Analysis of operating results for FY2022

①Revenue|205,618 million yen (+15,966 million yen YoY)

The Domestic Processed Food Business recorded an increase in

revenue amid strong sales of mainstay vegetable beverages in the

second half and the recovery in food service demand in the category of Food?Other. The International Business also posted an

increase in revenue amid increased demand for primary processed tomato products, the effects of price revisions, and yen

depreciation, in addition to robust sales to food service companies

in the United States.

②Core operating income|12,808 million yen (−1,329 million yen YoY)

The International Business posted increased profit on greater

demand for primary processed tomato products, as mentioned

above, but the Domestic Processed Food Business saw

decreased profit due to surging raw ingredient prices that outpaced price revisions and increased sales promotion expenses.

③Operating income|12,757 million yen (−1,253 million yen YoY)

Profits decreased amid the decline in core operating income.

④Net income attributable to shareholders of parent|9,116 million yen (−647 million yen YoY)

The effective tax rate declined amid the increased profit of overseas subsidiaries in low tax rate jurisdictions and tax incentives

implemented by countries. Therefore, the extent of the drop in net

income attributable to shareholders of parent narrowed compared

to operating income.

Financial analysis for FY2022

As of December 31, 2022, total assets increased by 10,163 million

yen compared to December 31, 2021. Current assets increased

by 5,677 million yen owing to the increase in inventories due to

efforts to accumulate inventory in preparation for soaring raw

ingredients costs. Non-current assets increased by 4,486 million

yen as a result of increased property, plant and equipment due to

updates in manufacturing equipment, etc. of overseas subsidiaries. Liabilities increased by 7,913 million yen due mainly to the

increase in borrowings following an increase in working capital.

Capital increased by 2,249 million yen since there was an increase

in net income attributable to shareholders of parent, etc., which

offset the decrease due to the acquisition and retirement of treasury stock.

FY2022 cash flow analysis

As of December 31, 2022, cash and cash equivalents decreased

by 9,840 million yen compared to December 31, 2021.

Net cash provided by operating activities was 4,635 million yen.

This was mainly attributed to 12,557 million yen in profit before

income taxes and 8,282 million yen in depreciation and

amortization.

Net cash used in investing activities was 9,457 million yen. This

was mainly attributable to outflows of 9,878 million yen for the

acquisition of property, plant and equipment as well as intangible

assets.

Net cash used in financing activities was 5,512 million yen. This

mainly reflects 7,786 million yen from the net increase in treasury

stock and 3,278 million yen used for the payment of dividends.

Financial Strategy in the Third Mid-Term Management Plan

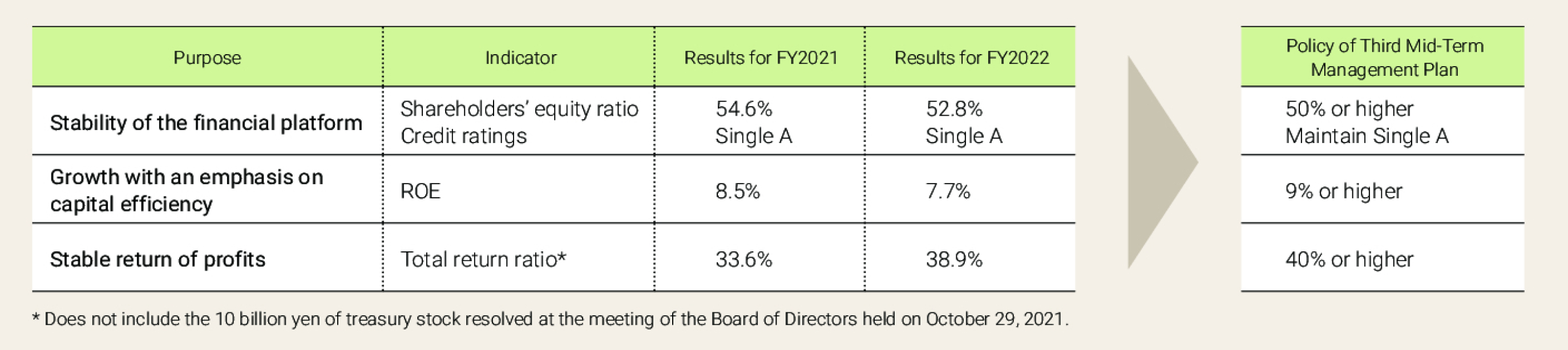

①Basic Policy of the Financial Strategy

It is the Group’s basic policy to balance both growth investment

and return of profits in our financial strategy based on a stable

financial structure. A stable financial platform is essential to supporting sustainable growth and having resilience in the face of

major changes. At the end of FY2022, our shareholders’ equity

ratio stood at 52.8% and our credit rating was Single A, indicating

a stable financial platform. However, the business environment

surrounding the Group is becoming more severe. This is because

of the worldwide shortage of tomato raw ingredients and surging

costs including for other raw ingredients.

Under this environment, Kagome is strategically increasing raw

ingredient inventory to provide a stable supply of products to

customers, controlling costs, and reviewing selling prices. In this

process, as part of our response to demand for funds from

increased working capital required for our operations, including for

inventory and in preparation for a temporary downturn in earnings,

we will incorporate new capital procurement methods, such as

issuing corporate bonds with digital benefit, while also relying on

borrowings from financial institutions. Therefore, during the third

Mid-Term Management Plan, we expect there to be temporary

phases where it may be difficult for us to maintain a shareholders’

equity ratio of 50% or higher and credit rating of Single A, which

are used as indicators of financial platform stability for the Group.

To breakthrough this severe environment, of particular importance will be achieving inorganic growth including through M&A,

not to mention the early restoration of profitability.

Investment in inorganic growth during the third Mid-Term

Management Plan is expected to amount to between 30 and 50

billion yen. We have secured capital toward this end through

treasury stock and our commitment lines and overdraft facilities

from financial institutions. Restoring profitability in organic

domains and achieving inorganic growth will make our financial

platform, which may temporarily erode, more stable and ultimately

result in medium- to long-term growth. Furthermore, in addition to

stability of the financial platform, we will pursue growth with an

emphasis on capital efficiency, including a Groupwide emphasis

on ROIC management and thorough investment management.

Also, during the third Mid-Term Management Plan, we plan to

provide stable and continuous shareholder returns so that the

total return ratio reaches 40% or higher, including dividends and

share buybacks. During the third Mid-Term Management Plan,

we aim to pay a stable dividend of at least 38 yen per share.

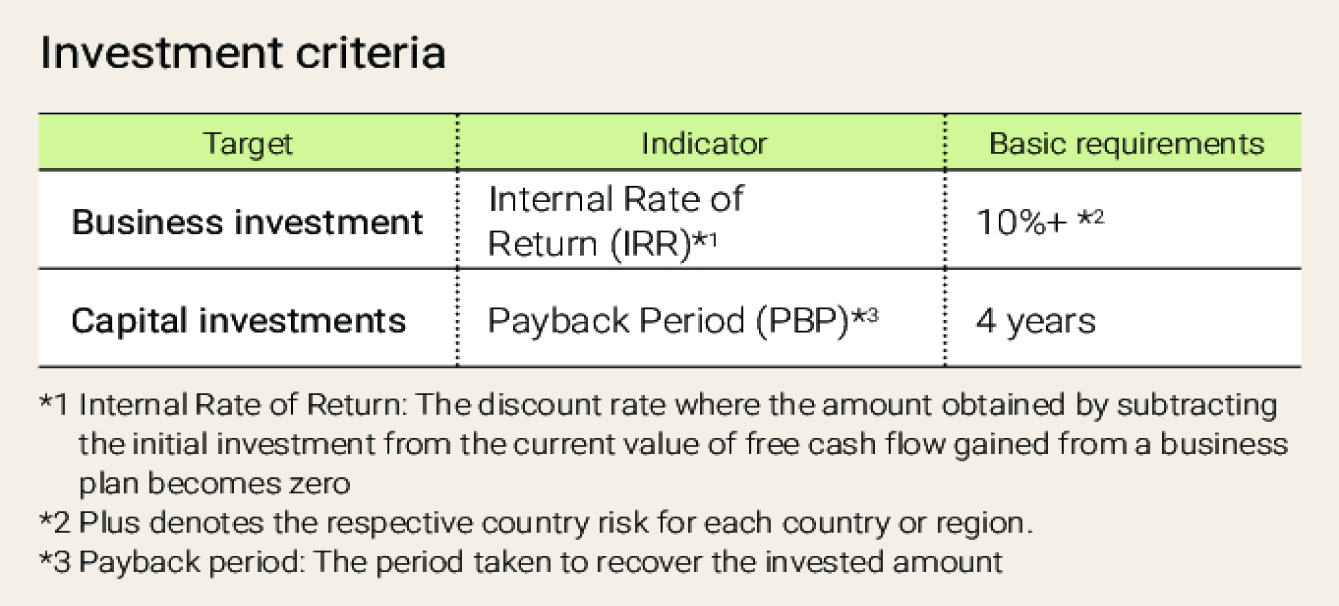

②Structure to ensure efficient investment

Investments in equipment and businesses are determined by the

Investment Committee, which consists of members selected from

specialized internal departments, after reviewing the investment

proposals of each department based on profitability and risk

assessment. The same committee also monitors each investment

to verify its effect. Proposals verified by the committee are submitted to the Board of Directors or the Management Meeting,

where they are deliberated officially.

Investment monitoring system

●Covers 5-year period post-execution

●Reported annually to the Board of Directors / Management Meeting

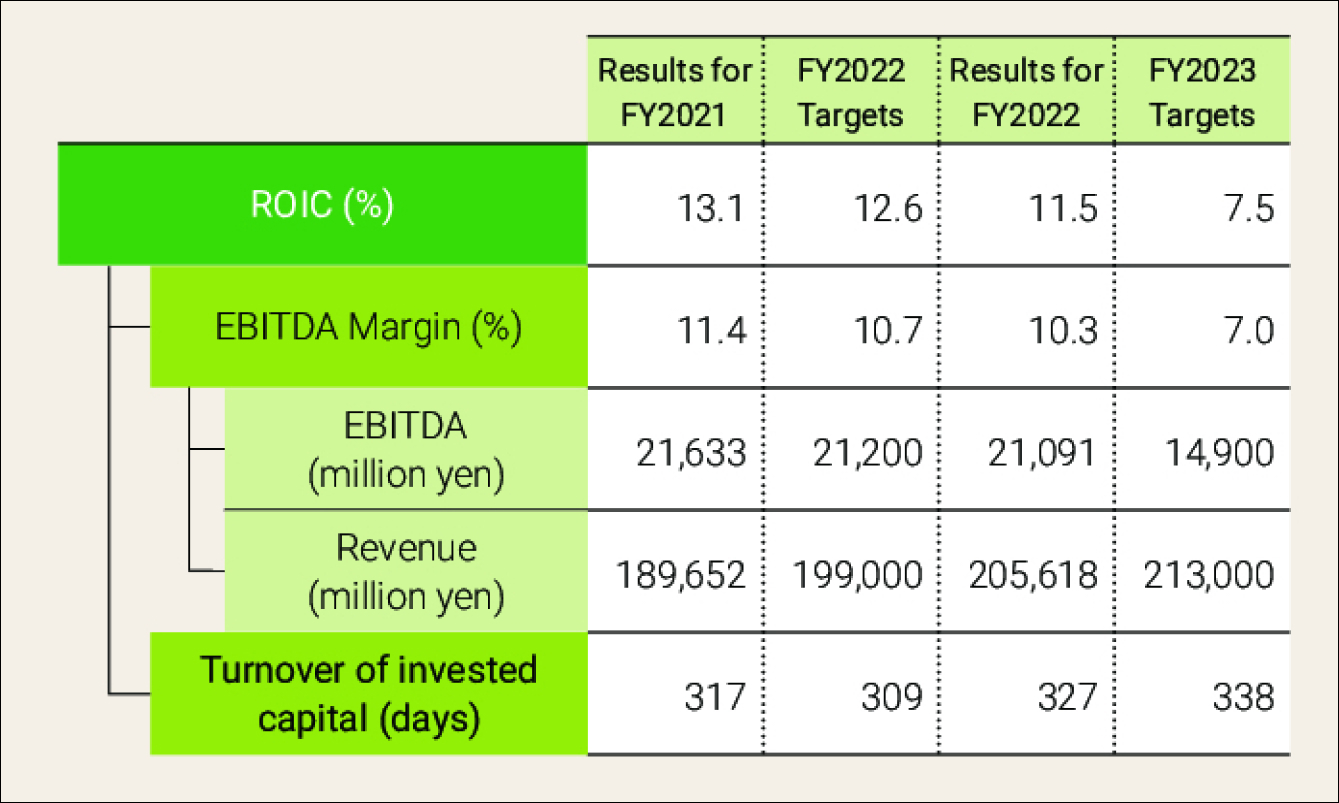

③Initiatives for improving capital efficiency

In FY2021, we introduced Kagome ROIC* management in order

to not only generate profits, but also measure the suitability and

efficiency of invested capital. Kagome ROIC measures the efficiency of invested capital compared to generated EBITDA. By

breaking down balance sheet items according to each element,

this approach aims to clarify themes that need to be improved.

Kagome’s targets and results for FY2022 are presented in the

table below.

In FY2022, revenue of the International Business increased

substantially, but the decreased profits of the Domestic Processed

Food Business resulting from soaring prices of raw ingredients and

energy caused our EBITDA margin to decline. Additionally, inventories increased largely causing turnover of invested capital to

increase. This was the result of changes in the external environment including soaring costs for raw ingredients and strategic

efforts to secure inventories as a countermeasure. Consequently,

FY2022 ROIC stood at 11.5%, 1.1 point lower than the target.

* Kagome ROIC: EBITDA ÷ Invested capital

(ROIC Tree implementation)

At Kagome, the ROIC tree is used as a control driver to increase capital efficiency. By implementing the ROIC tree, the balance sheet indicators that are broken down from ROIC can be incorporated into the KPIs of each department, and action plans based on this can be set by

each company / department, while the PDCA cycle can be self-driven to improve indicators. In addition, we will make improvements where

each company / department is aware of efficiency and implement initiatives including creating an optimal supply chain structure.

Achieving Both Capital Procurement and Growth

In 2023, we will try new capital procurement methods. As part of this, we have already issued a corporate bond with digital benefit called Kagome Bond to Support Health with Vegetables in Japan in the

amount 1 billion yen. This corporate bond with digital benefit utilizes Mizuho Financial Holdings’ digital

engagement platform with blockchain technology, making it intrinsically different than conventional

corporate bonds. These differences include a low unit purchase price, as well as the ability to obtain the

information of bond holders with bondholder consent, and to provide Kagome products to bondholders

as a benefit.

Currently, Kagome is supported by around 190,000 “fan shareholders.” It is our hope that we can

create “fan lenders” among the bondholders of this corporate bond with digital benefit. We also hope to

create relationships where we deepen people’s understanding of our products through financial instruments and encourage investors to buy our products.