Points of Business Performance

FY2024 Highlight (IFRS)

Million yen

2023/12

2024/12

YoY

YoY rate

Revenue

224,730

306,869

82,138

36.5%

Operating income

19,476

27,094

7,618

39.1%

Net income attributable to shareholders of parent

10,432

25,015

14,583

139.8%

【Revenue / Operating income / Net income attributable to shareholders of parent】

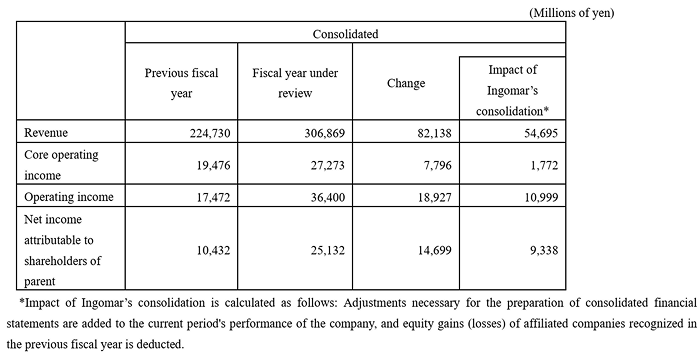

The Company aims to become a “strong company capable of sustainable growth, using food as a means of resolving social issues” under the four-year Mid-Term Management Plan starting from the fiscal year ended December 2022. The Company will work on the basic strategy that is to achieve sustainable growth by taking four actions (“1. Promote behavioral change in terms of vegetable intake,” “2. Change to fan-based marketing,” “3. Pursue both organic and inorganic growth,” and “4. Strengthen the Group's management foundation and foster a culture for tackling challenges”) that are organically connected, in an effort to further enhance corporate value. In the fiscal year under review (January 1 to December 31, 2024), the Company continued to face surging raw materials prices worldwide centered on processed tomato products. Japan continued to face an uncertain situation regarding the future outlook because of consumers’ heightened awareness toward cutting costs caused by inflation. Amid this environment, in the Domestic Processed Food Business, prices of certain products in vegetable beverages and tomato condiments were revised in response to surging prices of mainstay raw materials. In return, measures to spur on demand were actively implemented to minimize weakness in demand. As a result, we were able to rein in the decline in sales volume more than expected, leading to higher revenue and profit. In the International Business, in addition to rising selling prices of tomato paste, there were strong sales to food service companies. The Company acquired an additional equity stake in equity-method affiliate Ingomar Packing Company, LLC (“Ingomar”) in January 2024, making the company a consolidated subsidiary, in order to drive inorganic growth. This resulted in a net increase in revenue. As a result, the International Business posted higher profit on higher revenue. Furthermore, as the Company acquired additional membership interests in Ingomar, it recorded 9,323 million yen in “other income” as a market valuation gain on its existing equity stake in Ingomar. Year-on-year changes in consolidated performance for the fiscal year under review and the impacts from the consolidation of Ingomar are presented below.

Based on the above, revenue in the fiscal year under review increased to 306,869 million yen, up 36.5% year on year, and core operating income increased to 27,273 million yen, up 40.0% compared to the previous fiscal year. Operating income increased to 36,400 million yen, up 108.3% year on year, and net income attributable to shareholders of parent increased to 25,132 million yen, up 140.9% compared to the previous fiscal year.

*Core operating income is the profit index which measures recurring business performance by deducting cost of sales and selling, general and administrative expenses from revenue plus equity gains (losses) of affiliated companies.

Forecast (IFRS)

FY2025 Earnings Forecast

Revenue

Core operating income

Operating income

Net income attributable to shareholders of parent

2025/12

300,000

24,000

24,000

14,000

The Company is working to achieve its Mid-Term Management Plan by fiscal 2025, aiming to become a “strong company capable of sustainable growth, using food as a means of resolving social issues” under its vision of transitioning from a tomato company to a vegetable company. For the fiscal year ending December 31, 2025, our key issues will be to achieve a recovery in profits and continue to tackle challenges in the domestic business as well as accelerate the growth in the international business. In the domestic business, market prices for tomato paste, a mainstay raw material, are expected to decline, while various costs, including those for other raw materials and logistics, are expected to increase. Therefore, we will continue to focus on promoting behavioral change in terms of vegetable intake and creating demand primarily through fan-based marketing and work to generate profits. Additionally, we will focus on three areas?soup, plant-based food, and plant-based milk?and take on the challenge of expanding our business domains and cultivating new pillars of sales growth. In the International Business, amid a sharp drop in tomato paste prices, by strengthening collaboration globally, we will strive to strengthen the foundation for tomato primary processed products and accelerate the sales growth of our tomato secondary processed products for food service companies. In addition, we will continue to strengthen the foundations that support medium- to long-term business growth, such as by expanding agricultural research centered on the Global Agri Research & Business Center and by improving the efficiency of our supply network to deal with rising logistics costs.

- 1. This forecast for 2020 is based on International Financial Reporting Standards (IFRS) because Kagome started using these standards in 2019.

- 2. Rebates involving sales are deducted directly from revenue. In prior years, rebates were included in selling, general and administrative expenses.

- 3. Core operating income is an indicator of earnings from continuing operations. This income is revenue minus the cost of sales and selling, general and administrative expenses and includes equity gains of affiliated companies.