top message

Third Mid-Term Management Plan

Market Understanding and Earnings Evaluation for the First Year

A year of upheaval in the management environment

In 2022, we kicked off our third Mid-Term Management Plan,

which contains the basic strategy of pursuing top line growth

based upon our inherent ability to generate profits.

From the plan’s outset, however, a number of events

occurred, including the rapidly changing situation in Ukraine,

sharp depreciation of the yen, and a spate of natural disasters

gravely impacting agriculture. This resulted in an upheaval in

the management environment on a scale that we have never

experienced before.

In April 2022, we increased prices mainly of tomato condiments after factoring in rising costs associated with the economic recovery from the pandemic in our initial management

plan. Nevertheless, as time passed, the sheer scale of rising

prices for raw ingredients grew larger and for this reason,

we announced revisions to our full-year earnings forecast in

July 2022.

Additionally, we found that these higher prices for raw ingredients were not transient and would continue throughout the

period of the third Mid-Term Management Plan. Accordingly,

we revised our medium-term strategy for the stable

procurement of raw ingredients, implemented additional measures to reduce cost of sales, and conducted promotions

based on changes in the purchase behavior of customers.

In this manner, the entire company worked as one to address

these themes urgently. The year 2022 proved to be a time

when our employees displayed their ability to adapt to change

fostered during the pandemic, as they responded to the situation in a flexible and agile manner.

FY2022 earnings evaluation

In the Domestic Processed Food Business, a major theme

was restoring sales of vegetable beverages, our mainstay

product, in addition to addressing rising prices of raw ingredients. By addressing customers’ mindset during the pandemic

of wanting to eat more vegetables to build their immunity, we

have been able to grow sales of our vegetable beverages.

However, tougher competition following the increased number

of products to address people’s vegetable consumption needs

caused sales of Yasai Seikatsu 100, our mainstay brand, to fall

below the level seen in FY2021.

The reason was because customers were thinking less

about Yasai Seikatsu 100’s fundamental value of providing a

Becoming a strong company capable of

overcoming challenges, sustainable growth,

and resolving social issues

We are facing a management environment with an unprecedented level of difficulty caused by the growing

severity of climate change, rising geopolitical risks, and ongoing depreciation of the yen, among other factors.

Nevertheless, I promise our stakeholders that we will overcome these challenges as we move toward what

Kagome strives for by 2025 and become an even stronger corporate group.

TOP MESSAGE

Section 1 Section 2 Section 3 Section 4 Section 5 Section 6 Section 7

TOP MESSAGE

3 KAGOME INTEGRATED REPORT 2023 KAGOME INTEGRATED REPORT 2023 4

President & Representative Director

quick and delicious boost to vegetable deficient diets. Based

on this, we changed direction of our information dissemination and promotions from the second half, enabling us to

recover sales to a level above the previous year in the final

two quarters.

In the International Business, raw ingredient prices continue

to rise. In response, we steadily reflected increased costs in

selling prices while also working to capture demand from the

food service and home meal replacement markets.

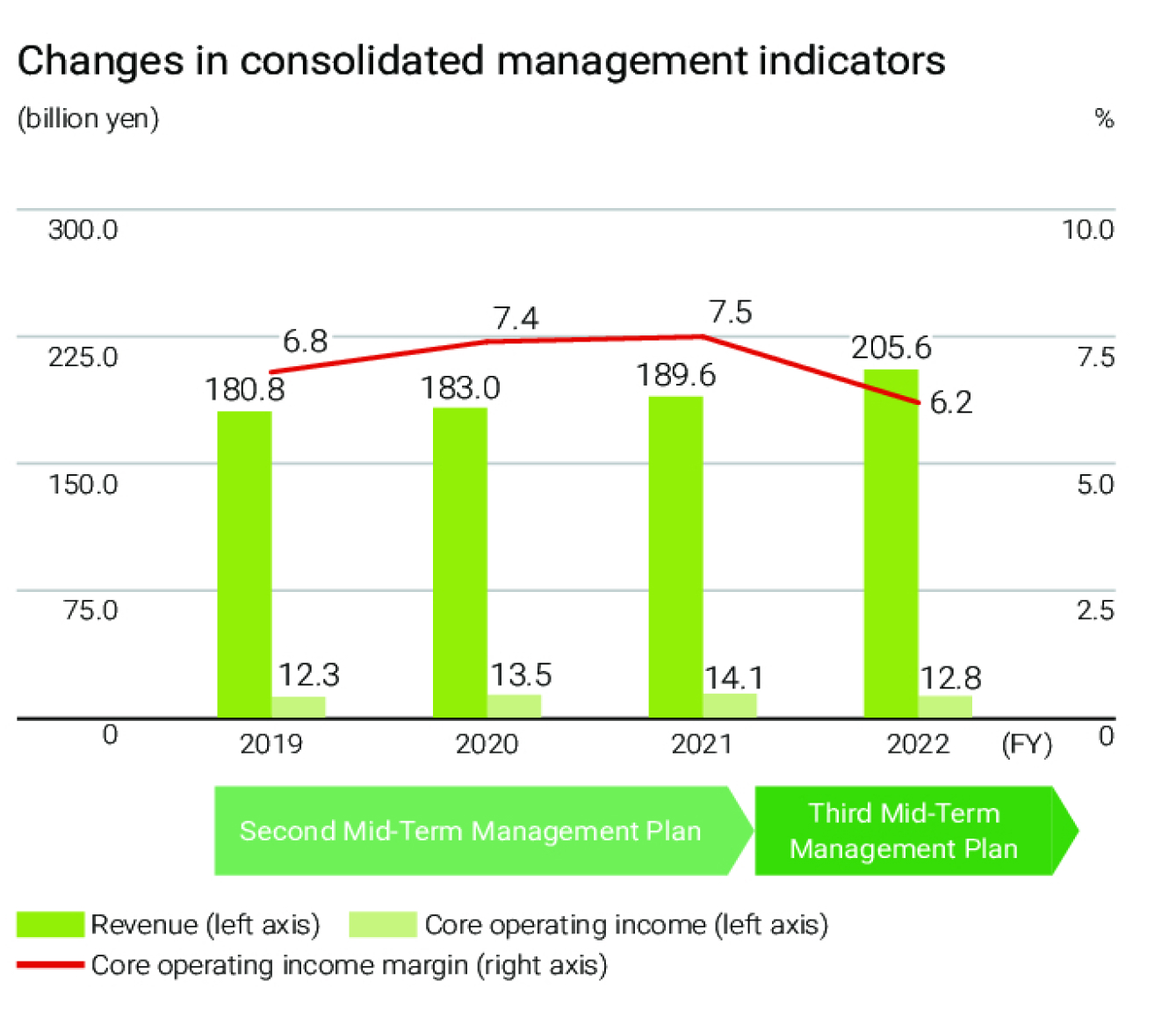

As a result, Kagome’s earnings in FY2022 featured revenue

of 205.6 billion yen (up 8.4% YoY) and core operating income*

of 12.8 billion yen (down 9.4% YoY). We managed to achieve

results beyond the earnings forecast revised in July 2022. This

provides us with positive momentum heading into FY2023.

* Core operating income is a profit index that measures constant business performance

by deducting cost of sales and selling, general and administrative expenses from

revenue plus share of loss (profit) of entities accounted for using equity method.

2023 as a Turning Point

Agile response in the face of higher costs and

strengthening of business exploration for the

next pillar of growth

We order many natural farm-produced ingredients, which are a

mainstay raw material, in bulk one year ahead in the amount

required for the next year. Therefore, natural farm-produced

ingredients processed in 2022 are actually used in 2023. In

2022, the price of these ingredients including tomatoes surged

worldwide, but we will actually feel the impacts in 2023. The

increased amount of costs in 2022 and 2023 is expected to

be more than the 14.1 billion yen of core operating income

recorded in FY2021. This is the largest ever increase in costs

that we have experienced in such a short amount of time. It’s

truly a crisis situation. While profits will decline in FY2023,

how we deal with this crisis will have a major impact not only

on our short-term performance, but also the very future of

Kagome. For this reason, 2023 represents a genuine turning

point in our history.

In 2023, we will swiftly implement two initiatives. First, we

will respond agilely to bounce back from higher costs. As a

responsible manufacturer, we will strive to increase productivity and reduce loss. Nevertheless, the sudden and substantial

cost increases we are dealing with now have gone beyond the

level that can be dealt with using our own efforts. In response,

we carried out price revisions for approximately 150 consumer

products and approximately 178 institutional and industrial

use products in February 2023 after carefully explaining our

situation to customers and business partners, including on

the distribution side. Going forward, the entire Kagome Group

will work together to quickly restore sales volume which is

expected to decline temporarily following these price revisions. In the beverage business, starting in spring 2023, we

will roll out a bold new approach to communication embodied

by the concept of “promoting vividly colored vegetables that

make our everyday brighter.” Additionally, in the food products

business, we will step up information dissemination of tomato

condiments centered around Rice Omelet StadiumR 2023, a

competition that will decide the best tasting rice omelet in

Japan. These activities will not only restore demand, but also

help to generate new demand.

Moreover, we will step up our response to stable procurement of natural farm-produced ingredients. Kagome imports

more than 90% of these ingredients and our procurement

network spans some 179 locations (as of FY2021). This is the

result of our many years of efforts to build a diversified global

procurement network. This also helps us to minimize impacts

from changing crop conditions of each growing area. In critical growing areas such as Australia and Portugal, we have

established and expanded subsidiaries locally. With that being

said, to deal with surging prices for natural farm-produced

ingredients, emerging geopolitical risks, and the growing intensity of climate change over the medium to long term, we

strongly recognize the need to further reinforce our global

procurement network and we are now working to restructure

it recognizing this as an important theme.

Second, we are strengthening our exploration of businesses

that will become new growth pillars. Cost and time are

required for this, and over the next several years, the severe

management environment is expected to persist. However, if

we reduce the size of these exploration activities now, we will

be unable to grow further several years down the line. We are

strongly committed to sustaining these exploration activities

for new business in order to overcome the severe situation

and achieve sustainable growth.

Progress of the Third Mid-Term Management Plan and Future Initiatives

Steadily moving ahead with four actions to

achieve what Kagome strives for by 2025

The third Mid-Term Management Plan spans the four-year

period from 2022, seeking to achieve the target of what

Kagome strives for by 2025, which is defined as “become a

strong company capable of sustainable growth, using food as

a means of resolving social issues.” This vision reflects the

very value creation process that generates both social value

and economic value through our business activities. Even if

the management environment changes, this fundamental

approach will remain the same. But, we will review our quantitative targets set for 2025. Currently, revenue is outpacing

the initial target of 2% CAGR thanks to rising sales of the

International Business and price revisions. On the other hand,

core operating income has fallen short of our initial assumptions due to rapidly rising raw ingredients prices. Given this

situation, we will set new quantitative targets for 2025 and

announce them before the financial results briefing in

February 2024.

The basic strategy of the third Mid-Term Management Plan

is to achieve sustainable growth by taking four actions that

are organically connected. It represents the key to mediumterm growth under an increasingly severe management environment, and the entire Group is now working steadily toward

this end.

Progress of the four actions

①Promote behavioral change in terms of

vegetable intake

Increasing vegetable consumption represents an important

initiative that resolves the social issue of helping people live

longer, healthier lives and leads to Kagome’s sustainable

growth. We will continue actively sharing information that will

promote behavioral changes to notice one’s own vegetable

deficiency and increase vegetable consumption. VegeCheckR*

surpassed a running total of 2.32 million measurements in

January 2023 following progress made with building out the

service structure over the past two years. We are installing the

machines in supermarkets and other stores, having confirmed

that they result in increased customer purchases of fresh

vegetables, and that VegeCheckR measurements serve as a

reason for visiting a store. Amid growing expectations from

distribution and retail, we will now quickly build a system for

increasing the number of VegeCheckR machines, whose measurements directly lead to behavioral change for vegetable

consumption, and promoting their continued use, as a key

content of this action.

* VegeCheckR: A device that measures vegetable intake level (0.1 to 12.0) and estimated

vegetable intake volume (according to six levels; g) simply by holding the palm of your

hand over a sensor for tens of seconds. Measurement is completed in tens of seconds

providing the convenience of being able to view results on the spot.

②Change to fan-based marketing

Fan-based marketing is a marketing activity for increasing

Kagome fans who identify with our brands, products and

services as well as who feel a strong sense of loyalty. We are

now working to develop various interactive content linking

farming with living and expanding opportunities to supply this

content. This activity aids in resolving the social issue of agricultural development and regional revitalization, and it passes

down our commitment since our founding to create value

from agriculture and deliver this to our customers.

Starting in 2022, we have been promoting an activity called

“food education beginning with growing.” This is because of

the survey Kagome conducted that found roughly half of all

people who consume 350 g or more of vegetables every day,

as recommended by the Ministry of Health, Labour, and

Welfare (MHLW), had experience cultivating or harvesting

these vegetables when they were children. Based on this

finding, we started “food education beginning with growing”

with the commitment to increase the number of future vegetable fans by providing children with opportunities to plant

and grow vegetables. Specifically, at Yasai Seikatsu Farm

Fujimi, we offer interactive classes where participants can

harvest vegetables seasonally. We also hold cultivation

classes and distribute tomato seedlings and organize tomato

harvesting events in stores. By organically developing a broad

range of interactive contents on vegetables, we will increase

contact points with vegetables

③Pursue both organic and inorganic growth

・Organic growth

Focusing on the domestic business’ ability to create demand

and the international business’ growth potential

Under the third Mid-Term Management Plan, we are pursuing

sustainable growth from the two angles of stable organic

growth of existing businesses and inorganic growth by acquiring new resources from M&A and other means.

First, with regard to organic growth, in the Domestic

Processed Food Business, we will focus on creating new

demand and restoring demand following the price revisions

I mentioned above.

Additionally, the organic growth of the International

Business will become a critical point in 2023. Particularly, the

primary processing business that manufactures tomato paste

and other products has seen its market environment undergo

significant changes. Before the pandemic, there was a worldwide surplus in tomato paste inventories and prices had been

stagnant. Therefore, Kagome’s primary processing business

had implemented a strategy of rationalizing production

volume to secure profits. The situation changed as food service demand increased after the resumption of economic activities from the pandemic, and this coupled with climate

change and the situation in Ukraine, caused a tightening in the

supply-demand balance for tomato paste. Considering that

the unstable international situation and growing climate risks

likely will continue going forward, it is very important now to

review the strategy of our primary processing business.

Capitalizing on our strength of owning subsidiaries in primary

processing, we will further strengthen a foundation underpinning the organic growth of the International Business by

securing stable production and supplies of tomato paste.

・Inorganic growth

New business creation through open innovation and growth

strategy in the United States

Three initiatives we have been working on over the past several years emerged as new budding businesses in 2022. First

is our partnership with TWO Inc., a start-up company involved

in plant-based foods. In 2022, we released a plant-based

omelet rice as a frozen food product made using Ever Egg, a

plant-based egg made from carrots and white beans, as our

first foray. This product received rave reviews from our distribution partners and customers. Following this success, in

April 2023, we will launch our second jointly developed product. We intend to use these new products to attract new users

of plant-based foods. Second is the launch of SOVER, a new

plant-based food brand established through our partnership

with Fuji Oil Co., Ltd. In October 2022, we began selling a

cereal made from soybeans and vegetables exclusively on our

official website in an effort to generate a new avenue of

demand. Third is the farm management support business for

processing tomatoes powered by AI. We established DXAS

Agricultural Technology LDA in Portugal together with NEC

Corporation. This new company is providing services to promote more eco-friendly and profitable farm management.

Going forward, we will continue to create buds of new growth

from such open innovation to quickly develop new businesses

that can contribute to our bottom line.

Regarding our growth strategy in the United States, the US

Growth Strategy Department established in 2021 is spearheading multi-faceted reviews on partnerships with other

companies and achieving inorganic growth through M&A and

other means.

④Strengthen the Group’s management foundation

and foster a culture for tackling challenges

Strengthening the Group’s management foundation is vital to

both flexibly addressing current themes and tackling the challenges posed by medium- to long-term growth. In particular,

regarding strengthening the value chain, as I have mentioned,

we have been working to further expand our global procurement network and also expand procurement of raw ingredients in Japan.

In terms of promoting digital transformation (DX), our implementation structure features the Digitalization Promotion

Committee, which is responsible for IT strategy planning

and deciding on major DX projects, and the DX Promotion

Committee, which covers human resource development and

efforts to foster a culture of DX. We are now making progress

with boosting productivity by building out our customer information systems and using RPA. In addition, we are implementing a training program targeting 10% of our workforce by 2025

to foster human resources who can tackle DX themes

independently.

We must continuously create innovation in order to achieve

sustainable growth as a company. Kagome believes that

providing a workplace where its diverse workforce can exercise their potential while feeling job satisfaction will result in

the creation of innovation. Toward this end, we are actively

hiring to reinforce diversity and foster a more inclusive culture.

We are focusing the most on creating a culture that values

psychological safety and establishing an environment where

our diverse workforce can frankly discuss matters and

exchange their opinions. We will increase psychological safety

and foster a culture that embraces the act of tackling challenges through analysis of the engagement survey and holding open discussions with employees through Talk with Top

Management.

Accelerating solutions to social issues by

reinforcing our sustainability initiatives

Establishment of Sustainability Committee

and strengthening of risk management

system

Kagome engages in business activities that integrate agriculture, with health and everyday living. This is why sustainability

initiatives fit perfectly with our business activities seeking to

become a company capable of sustainable growth, using food

as a means of resolving social issues. Therefore, we need to

reflect long-term opportunities and risks into management

strategy. Toward this end, we established the Sustainability

Committee in 2022, putting into place a system for discussing

and reviewing matters with a longer term perspective and for

addressing material issues. The Sustainability Committee has

established four sustainability themes that once addressed

will enable us to create long-term value and achieve a sustainable society. These four themes are sustainable agriculture,

circular economy, reduced environmental impacts, and

CSR in the supply chain. Through its subcommittees the

Sustainability Committee is preparing for the future and examining our response, reflecting these findings in management

strategy.

Among the social issues we are looking to resolve, climate

change in particular has become even more serious. We

established a new reduction target for greenhouse gases for

2030, with the ultimate goal to achieve net-zero emissions of

greenhouse gases by the Group by 2050 to help prevent global

warming. This new target has received certification from the

Science Based Targets initiative (SBTi)*. To achieve this target,

we have prepared a roadmap leading to 2030 through our

company-wide cross-functional CO2 Reduction Project. Going

forward, we will actively invest in the environment with a longterm perspective following this roadmap.

Given the severe changes in management environment, we

established the position of CRO (Chief Risk Management

Officer) and the Enterprise Risk Management Committee in

order to clarify our system and roles within risk management.

This provides us with a mechanism for identifying and dealing

with specific risks.

* Science Based Targets initiative (SBTi): An international initiative to certify that a company’s reduction target for greenhouse gases is consistent with the standards set out in

the Paris Agreement

Overcoming today’s challenges alongside stakeholders with

strong conviction

Today, the Kagome Group faces an unprecedented situation

of cost increases never seen before. Such a situation dictates

that we are even more aware of our vision to become a

“strong company capable of sustainable growth, using food as

a means of resolving social issues” and do what needs to be

done. In this manner, we are more than prepared to overcome

this situation. The cooperation and support of our stakeholders is also a key ingredient. We intend to evolve into a Kagome

Group that can grow continuously by co-creating new value

together with stakeholders.

In closing, I ask for your continuing support and understanding as we move forward.

Satoshi Yamaguchi

President & Representative Director