CFO/CRO message

Q1 Can you provide an overview of Kagome’s performance in FY2023?

Revenue was up 9.3% year on year. Revenue increased across all business segments. This was because in the International Business in particular, demand recovered centered on processed tomato products, we made progress with passing on higher costs to selling prices, and we increased the amount of foreign currency conversions to yen amid yen weakness.

Core operating income was up 52.1% year on year. In the Domestic Processed Food Business, we narrowed the initially forecast loss from the previous fiscal year by actively working on cost reductions, in addition to price revisions, to offset the substantial increase in costs due to soaring raw materials and energy prices. Additionally, the core operating income of the International Business greatly increased, similar to revenue.

Net income attributable to shareholders of parent increased 14.4% compared to the previous fiscal year. Factors causing a decline in net income attributable to owners of parent from core operating income were the impairment losses on fixed assets in the Domestic Agri-Business. The Domestic Agri-Business is

structured in a way that selling prices are greatly affected by market conditions. The main reason for recording impairment losses was because we determined that it is unclear whether we can fully reflect future cost increases in selling prices.

The operating environment has experienced sudden changes, and yet, we were able to record higher revenue and profits for FY2023 and provide dividends to shareholders in excess of our initial target.

Underpinned by this performance, ROIC* also improved 1.7 points to 13.2%. This was mainly attributable to a substantial increase in profits. In terms of our invested capital, inventories increased markedly by 17.6 billion yen compared to the previous fiscal year. This was due to higher raw materials prices. In response to higher raw materials prices, we hiked selling prices and made efforts toward cost reduction, which has enabled us to maintain a sound cycle of invested capital and profits.

* Kagome ROIC: EBITDA ÷ Invested capital

Q2 Can you provide a review of the first half of the third Mid-Term Management Plan in terms of financial strategy?

The basic policy of the Group’s financial strategy is to strike a balance between growth investment and shareholder returns. It is important to maintain a stable financial platform in order to support sustainable growth and withstand major changes.

In FY2022 and FY2023, the first half of the third Mid-Term Management Plan, we were able to exceed the plan’s initial targets in terms of both revenue and core operating income, despite major changes in the operating environment. This was due to the fact that the International Business grew at a faster pace than expected. On the other hand, in the Domestic Processed Food Business, we revised selling prices in response to the rapid increase in the cost of raw materials and other expenses. Initially, sales volume declined as a result, but in the fourth quarter of 2023, sales volume generally recovered to the previous year’s level.

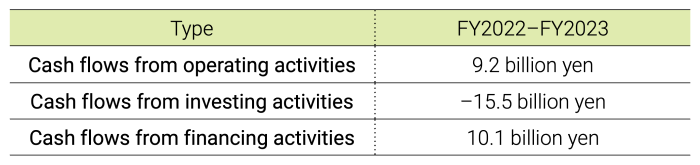

Cash flows for the same period are shown on the right.

● Cash flows from operating activities

Net cash provided by operating activities totaled 9.2 billion yen. Although profits were steady, the main reason for this was a decrease in cash of 22.3 billion yen over the two years due to an increase in inventories.

● Cash flows from investing activities

Net cash used in investing activities amounted to 15.5 billion yen. This was mainly due to the fact that we refrained from making non-essential and non-urgent capital investments in response to the weakening operating cash flow situation.

● Cash flows from financing activities

Net cash provided by financing activities was 10.1 billion yen. This was mainly due to borrowing to meet the demand for funds in FY2024 and onward.

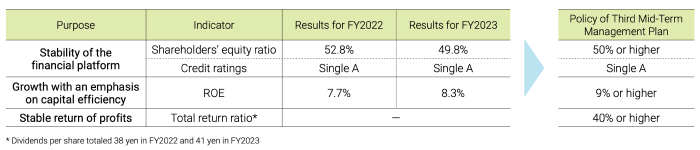

In terms of financial indicators, shareholders’ equity ratio* was 49.8% and Kagome’s credit rating is Single A. Although the shareholders’ equity ratio was slightly lower than the target of the third

Mid-Term Management Plan, we believe that our financial platform remains stable. As for capital efficiency, ROE was 8.3%. This was due to a temporary loss resulting from impairment of fixed assets in the Domestic Agri-Business. Excluding this loss, we achieved our target level of 9%. In terms of shareholder returns, we were able to increase the dividend by 3 yen per share from the previous fiscal year.

* Shareholders’ equity ratio: Ratio of equity attributable to shareholders of the parent

Q3 What are Kagome’s financial goals in the second half of the third Mid-Term Management Plan?

In FY2024 and FY2025, the second half of the third Mid-Term Management Plan, we will target revenue of 300 billion yen and core operating income of 24 billion yen based on the basic policy of restoring profits in the domestic business and accelerating growth in the International Business. This greatly exceeds the initial target set back in FY2022.

In particular, with regard to inorganic growth, in January 2024, we acquired an additional stake in Ingomar, an equity-method affiliate, making it a consolidated subsidiary. We expect that this will result in an increase of approximately 50 billion yen in revenue. This additional stake of approximately 36 billion yen represents the largest business investment ever made by Kagome. The funds required for this investment will be temporarily procured through borrowings. As a result, the shareholders’ equity ratio will fall below 50%. However, we plan to repay the borrowings by the end of the third Mid-Term Management Plan period through profits from Ingomar and the disposal of treasury stock, which will restore the shareholders’ equity ratio to over 50% again.

Based on these factors, our financial indicators for FY2025 are expected to exceed the basic policy. We will maintain the stability of our financial platform and strive for growth with an emphasis on capital efficiency. In FY2024, we plan to pay a dividend of 52 yen per share, including a commemorative dividend of 10 yen per share. We will maintain a total return ratio of 40% or more during the period of the third Mid-Term Management Plan, while returning profits from our business growth.

Q4 What is the significance of ROIC management?

As part of our initiatives for improving capital efficiency, we manage ROIC companywide, aiming to improve ROE in order to maximize corporate value.

In our financial structure, we need to achieve ROIC of 11 to 12% in order to achieve ROE of 9% or more. From this perspective, we have set ROIC targets for each business segment and have established a system to set KPIs and implement the PDCA cycle to achieve them.

Going forward, we will continue to evolve the PDCA cycle and link it to the awareness and actions of each and every employee in order to increase capital efficiency and maximize corporate value.

Q5 What is your approach to risk management?

One of the actions being taken during the period of the third MidTerm Management Plan is “Strengthen the Group’s management foundation and foster a culture for tackling challenges.” We believe that risk management will be a pillar that supports this management foundation.

Kagome’s risk management initiatives are structured so that each person, from executive management to individual employees, can take ownership and work on everything from the company’s priority risk issues to the risk issues of each organization.

In order to achieve the quantitative targets set out above, we believe that it is important to accurately understand the various risks arising from changes in the operating environment from each standpoint and take appropriate actions.