CFO/CRO message

Performance in FY2024

Our performance in FY2024 featured record highs in revenue and core operating income. In addition, the ratios of revenue and core operating income between the Domestic Processed Food Business and the International Business changed significantly, making 2024 a turning point for Kagome’s future growth.

Revenue reached 306.8 billion yen, an increase of 82.1 billion yen, or 36.5%, year on year. The Domestic Processed Food Business achieved revenue of 155.7 billion yen, up 13.5 billion yen, or 9.5%, from the previous fiscal year. Although affected by surging raw materials prices for tomato paste and the weak yen, price revisions and measures to stimulate demand implemented since last year proved effective. The International Business achieved revenue of 149.3 billion yen, up 71.1 billion yen, or 91.0%, year on year. The increase from Ingomar, which became a consolidated subsidiary, contributed greatly to our performance. In addition, the main factors behind the increase in revenue were the increase in the selling price of tomato paste in the tomato and other primary processing business, and the strong sales to food service companies in the tomato and other secondary processing business.

Core operating income reached 27.0 billion yen, up 7.6 billion yen, or 39.1%, year on year. The Domestic Processed Food Business achieved core operating income of 15.5 billion yen, an increase of 4.1 billion yen, or 35.7%, from the previous fiscal year. The main factors behind this growth were price revisions in response to significant increases in the cost of main raw materials, the rapid recovery of sales volume after the price revisions, and active efforts to reduce costs. The International Business achieved core operating income of 13.9 billion yen, an increase of 3.0 billion yen, or 28.6%, over the previous year. The increase in core operating income was primarily attributed to revenue growth and progress in passing on higher raw materials costs to product prices. Net income attributable to shareholders of parent increased to 25.0 billion yen, up 14.5 billion yen, or 139.8%, compared to the previous fiscal year. The increase from core operating income was a result of recording a gain on the step acquisition of Ingomar of 9.3 billion yen. As a result, we were able to provide shareholder dividends in FY2024 that exceeded our initial expectations. Underpinned by this performance, ROIC* came in at 12.4%, down slightly by 0.8 points. This is because although our bottom line rose thanks to such factors as the consolidation of Ingomar, invested capital also increased significantly. I believe that the balance between invested capital and profits is being maintained at a healthy level.

* ROIC represents Kagome ROIC calculated by EBITDA ÷ invested capital.

Approach to Cash Flow and Financial Strategy

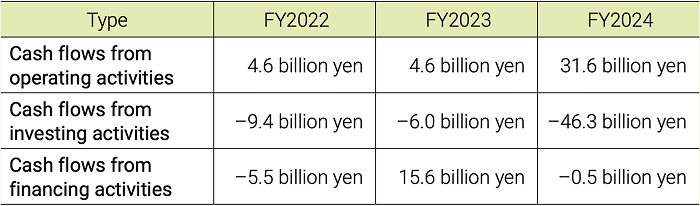

The Group intends to balance proactive investment for growth with substantial shareholder returns. At the same time, it is important to maintain a robust financial platform in order to support sustainable growth and withstand major changes. The trend in cash flows is as follows.

Cash flows from operating activities

Net cash provided by operating activities totaled 31.6 billion yen (net cash of 4.6 billion yen provided by operating activities a year earlier). The increase was owing to favorable profit trends as well as a 7.1 billion yen decrease in inventories.

Cash flows from investing activities

Net cash used in investing activities totaled 46.3 billion yen (net cash of 6.0 billion yen used in investing activities a year earlier). The main reason for this was the expenditure of 36.0 billion yen for the acquisition of the additional equity stake in Ingomar.

Cash flows from financing activities

Cash flows used in financing activities totaled 500 million yen (net cash of 15.6 billion yen gained in financing activities a year earlier). Although there was inflow of 23.1 billion yen from the disposal of treasury shares and other factors, the reason why net cash was used in financing activities as opposed to gained from them was mainly due to a decrease in short-term borrowings of 15.6 billion yen and dividend payments.

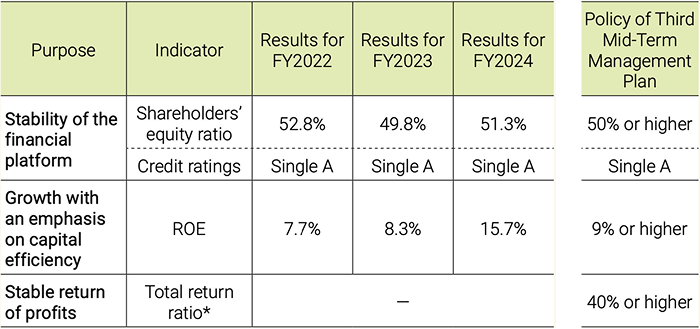

In terms of financial indicators for FY2024, the shareholders’ equity ratio* was 51.3% and Kagome’s credit rating is Single A. The shareholders’ equity ratio temporarily fell below 50% due to borrowings incurred for the acquisition of Ingomar, but it has sincerecovered to 50% through financing provided by the sale of treasury shares. As a result, we believe our financial platform remains stable. In terms of capital efficiency, ROE was 15.7%, exceeding the target level of 9%. In terms of shareholder returns, we were able to increase our ordinary dividend by 6 yen, in addition to offering a commemorative dividend of 10 yen per share. We will steadily achieve our shareholder return policy of a “total return ratio of 40%” during the period of the third Mid-Term Management Plan.

* Shareholders’ equity ratio : Ratio of equity attributable to shareholders of the parent

* Dividends per share totaled 41 yen in FY2023 and 57 yen in FY2024

Disposal of Treasury Shares

IIn July 2024, Kagome disposed of treasury shares, raising 23.2 billion yen. The proceeds were used to repay 36.0 billion yen of shortterm borrowings taken out to make Ingomar a consolidated subsidiary.

In our third Mid-Term Management Plan, we planned to invest 30 to 50 billion yen in business investments for inorganic growth, including M&A. This is based on maintaining a shareholders’ equity ratio of 50% and taking into consideration cash flows from operating and financing activities. We believe that these goals have beenlargely achieved through the disposal of treasury shares implemented in FY2024. To enable further business investment in the future, we will strive to achieve growth with an emphasis on capital efficiency while maintaining a stable financial platform.

In addition, with regard to this disposal of treasury shares, 30% was allocated to institutional investors, of which 80% was allocated overseas. During the roadshow, we received a variety of opinions from institutional investors, which we will use in our future management.

ROIC

As part of our initiatives for improving capital efficiency, we manage ROIC companywide, aiming to improve ROE.

For internal management, we do not use the common ROIC calculation method, but instead use EBITDA, which is core operating income plus depreciation, as the basis for calculating ROIC. We also created an ROIC tree and have each department set itsown KPIs to visualize its contribution. At the management level, we are working to analyze and improve ROIC for each business segment in order to optimize resource allocation and achieve sustainable growth. Going forward, we will continue to use these two approaches to improve capital efficiency and maximize corporate value.

Risk Management Initiatives and Issues

One of the basic strategies during the period of the third Mid-Term Management Plan is “Strengthen the Group’s management base and foster a culture for tackling challenges.” We believe that risk management will be a pillar that supports this management base.

Recently, as the proportion of International Business has increased and the establishment of a global risk management system has become increasingly important, we have been working to strengthen governance, particularly with regard to our overseas subsidiaries.

Kagome’s initiatives are structured so that each person, from executive management to individual employees, can take ownership and work on everything from the company’s priority risk issues to the risk issues of each organization, in an effort to strengthen the management base.